At the end of 2020, Deloitte, EY, Accenture, McKinsey, PwC, and Barclays each published a report on the topic of best banking practices. They analyzed 400 banks and fintech apps across North America and Europe, interviewing over 2000 users.

To save you hours of trawling through 1000+ page reports, we did the hard work for you and gathered the key highlights and insights from the top consultants. According to them, these 5 features will be pioneering the future of the banking industry.

critical web design mistakes to avoid

1. The app should consider users' financial health

According to PwC, 25% of people regularly have to set time aside to deal with personal financial issues at the expense of other aspects of their life.

Throughout 2020, we ran dozens of user tests and realized that most people have serious problems with saving money and managing their financials. They don't know the basics of savings, can't cut unnecessary expenses, or even struggle to identify them.

Turn the insights into action

Make sure to add functionality to your app that frees up some extra cash for your users. For example, point out when they might spend more than average and help individuals get back on track with their goals.

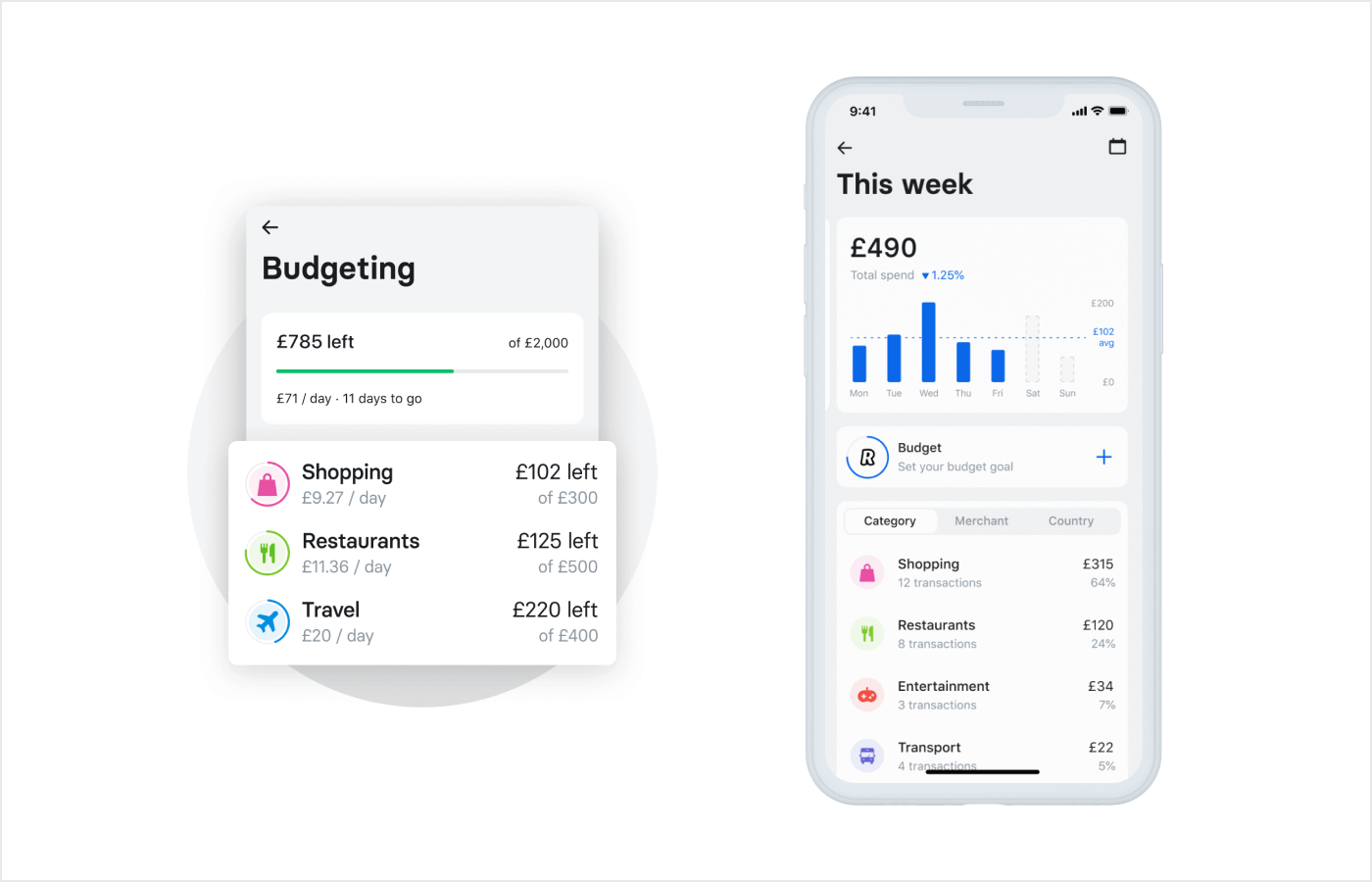

Revolut does that by displaying individual expense stats by category, giving users full control over their finances.

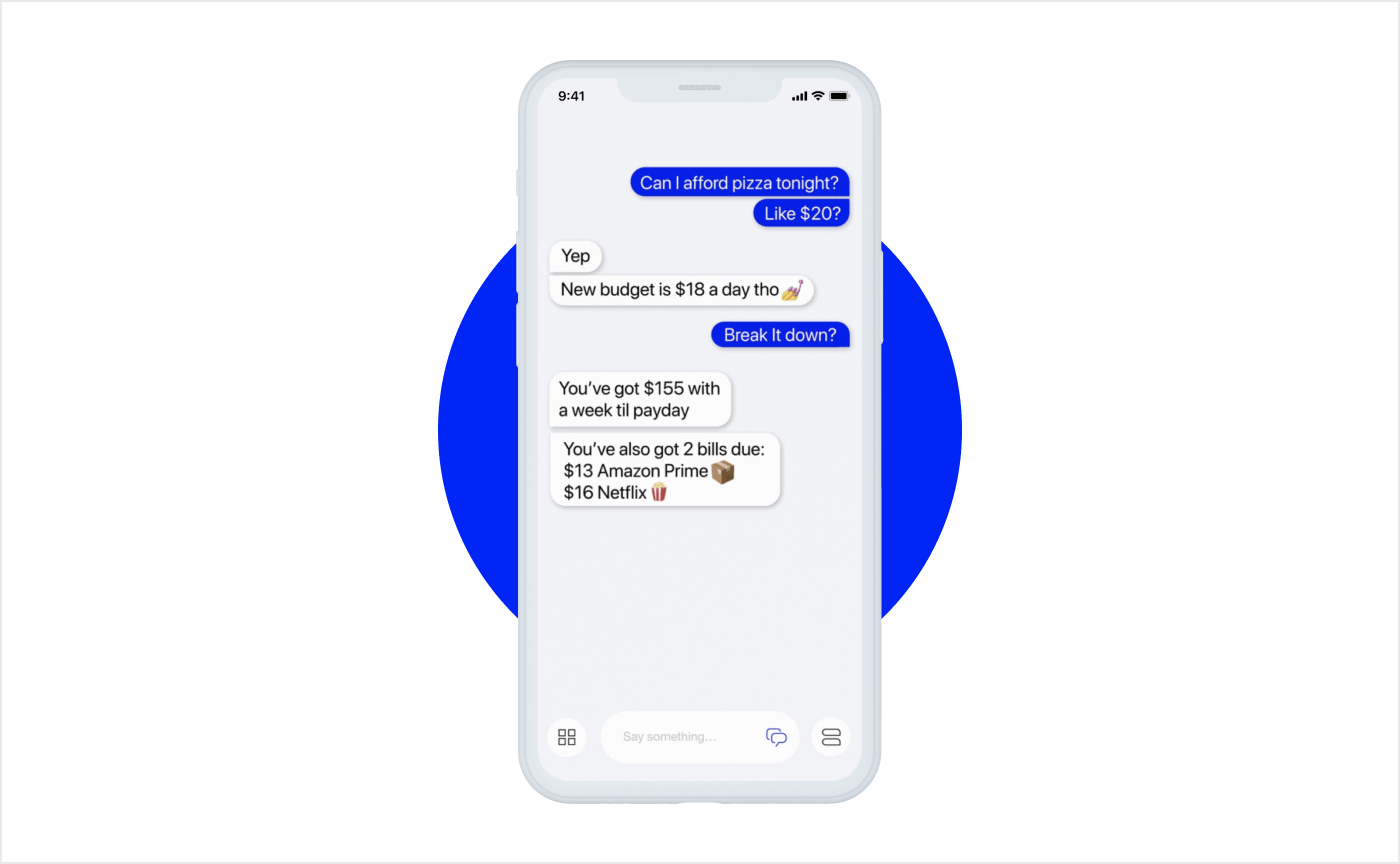

It can also be in the form of an AI financial assistant. For example, Cleo ($57.3M of investment) advises users on how much they can afford to spend right now.

In 2020, we designed 13 apps with an automatic savings feature. Want to find out more? Drop our design lead Dan a line.

BCG confirms that apps with similar personalized advice increase revenue by 10-30%. More than 90% of users are happy with the feature and are planning on using the service again, meaning it also impacts user retention.

Top tip for your interface

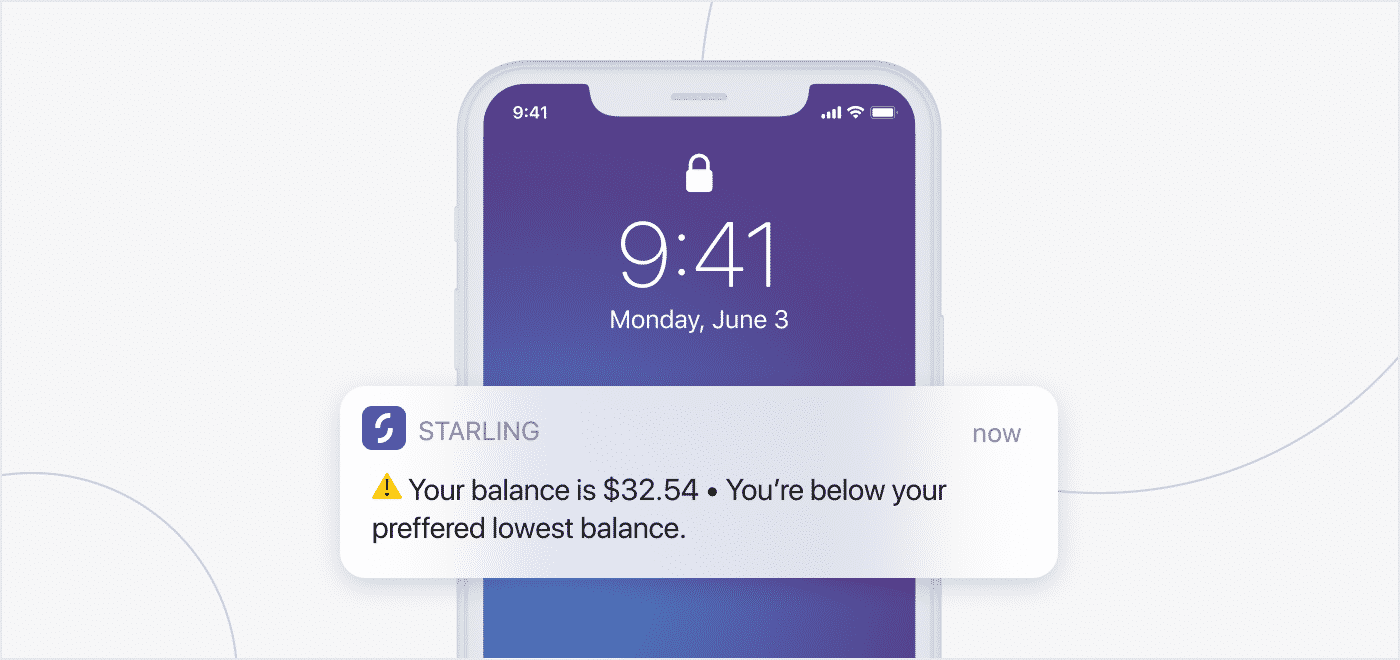

- Send low-balance notifications. Help people avoid becoming overdrawn or spending more than they planned by sending an alert whenever the balance in a designated account approaches a certain amount.

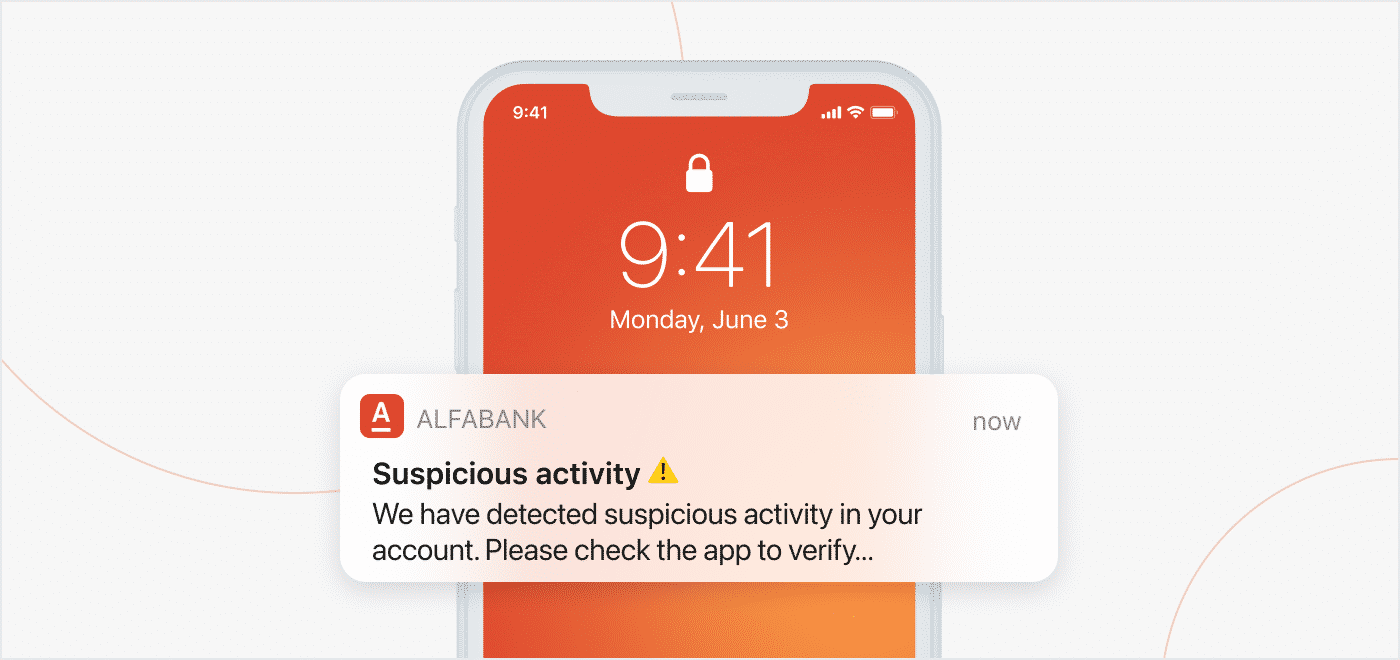

- Send alerts after suspicious activity. By tracking and analyzing a person's spending, apps can alert an individual of any unusual activity, such as purchases made in an unfamiliar location or lots of small purchases in a row.

2. Make it personal — really personal

Deloitte says that only 30% of users get personalized offers from their banks. The rest get irrelevant offers they have no interest in. For your product to be in demand, give the users exactly what they need at that particular moment.

A key to offering useful content is collecting data about user behaviors — spendings, demographic data, etc. With the data in-hand, you can create personalized offers your users will actually want.

Users are more likely to share the following info about themselves, in descending order:

- Spending details

- Location details

- Dates of life stage events (marriage, a child born, etc.)

- Social interactions: list of friends, coworkers

- Health data

It's best to collect this data and do it in real-time. After that, the data can be used for predictions and personalized notifications. BCG reports that banks that prioritize personalization enjoy a 10% revenue boost.

Here is the example

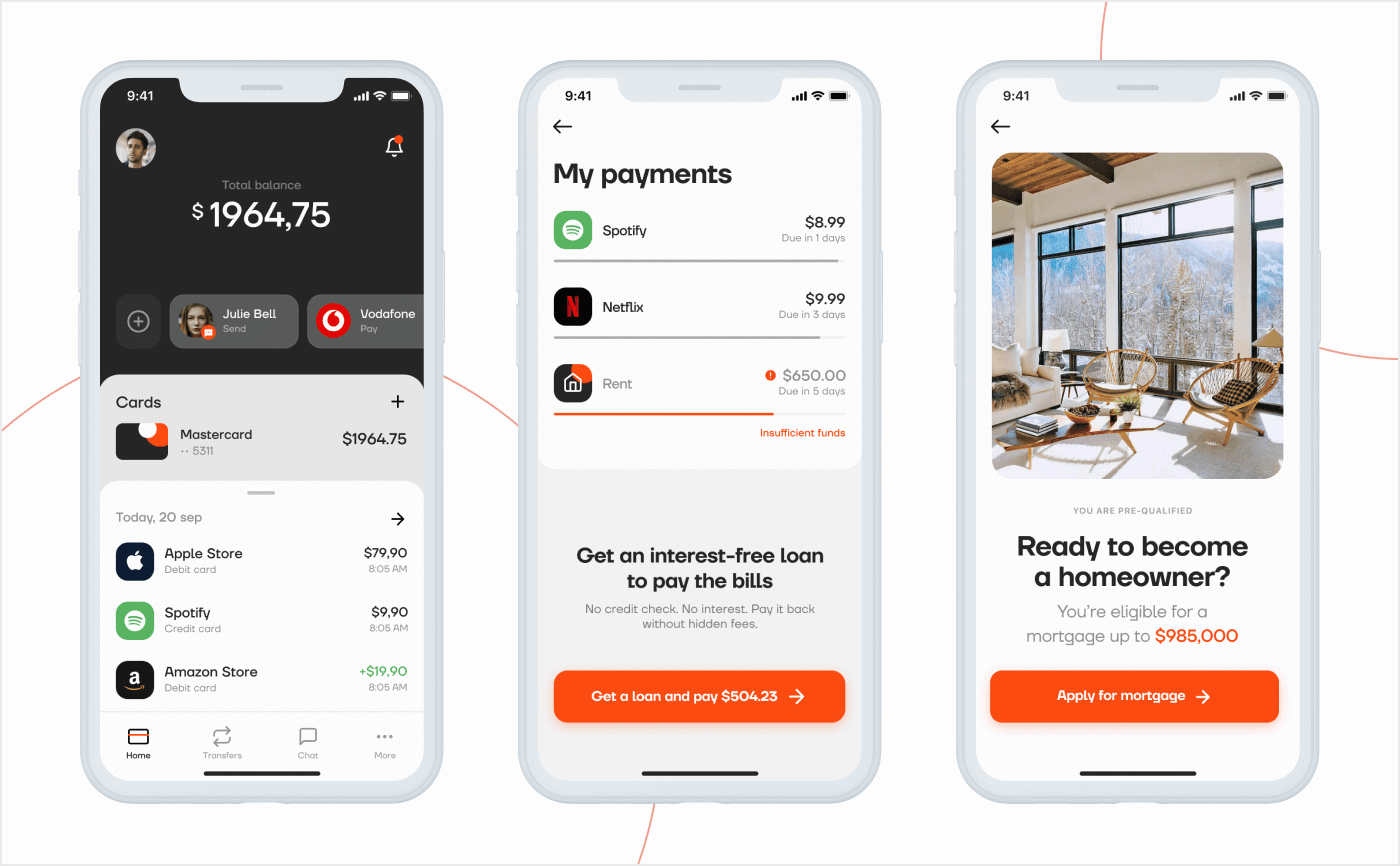

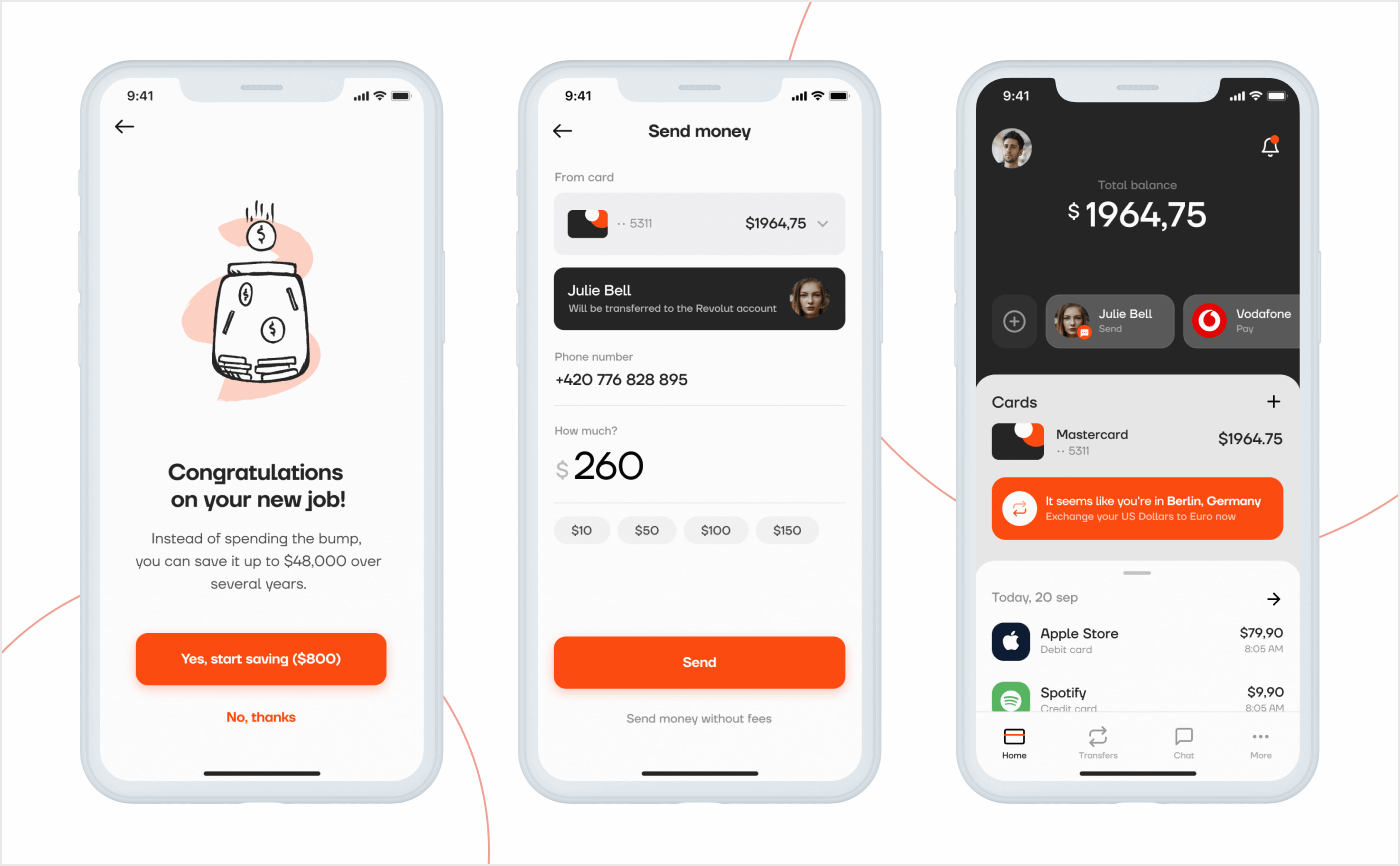

This app concept suggests smart auto-generated templates and gives users a heads up that their money will run low in two weeks due to rent payment, so it offers them a quick loan. Seems like a user is looking for a new home? Offer a mortgage.

Top tip for your interface

Personalization can be seriously powerful. Take Atom. The British challenger bank doesn't have a logo; users are free to generate one themselves. On top of that, users can set the name to Sam's Bank or whatever they wish.

3. Make online payments at lightning speed

Due to COVID-19 in 2020, people switched to online payments in droves. They carried out 30% more transactions digitally as compared to 2019 (hitting $350B spent online) — corresponding to six times the annualized 2019 growth rate of online retail.

This means that online payments are becoming an essential aspect of any bank. Making a payment, looking up payment history, analyzing it – if a bank fails in any of these features or can't keep up with the competition, it's guaranteed to lose users as they make up 50% of the online experience.

Turn the insights into action

Cut down the clicks needed to make an online payment: less clicks = less effort. A researcher from London went ahead and conducted benchmarking across a dozen banks. They found that users are destined to get bored and frustrated if it takes more than 13 clicks to complete payment.

If a user got a new job, offer an increased savings percentage. Allowing users to transfer money via email or phone number would also cut down the number of clicks needed. Location changed? Suggest currency exchange at a favorable rate.

4. Add new features to payroll

Nowadays, it's not enough to offer a convenient payment service. With so many banks fighting for customer loyalty, retention, and financial wellbeing, every fintech platform has to up its game.

Stats show that more than 70% of employed individuals have faced financial stress over the previous 12 months and would benefit from better access to liquidity. That's why most of the activities rotate around in-advance funds — Salary On-demand, Salary Advance, Early Direct Deposit.

Out of the 4,000 individuals EY surveyed, 3% to 5% had used an On-Demand Pay offering in the past, with a further 27% willing to consider it across a range of essential use cases.

If its potential is fully realized, On-Demand Pay could see adoption levels comparable to that of credit cards (37% and 58% in the UK and US, respectively) and above overdrafts (12% in both the UK and the US).

Turn the insight into action

Offer salary on-demand while giving your users flexible access to earned wages. For example, employees of companies that use NowPay ($2.1M of investment) can request salary advances directly through its mobile app.

A similar option is Salary Advances. Provide short-term credit to employees based on their salary and avoid the exorbitant rates charged by payday lenders.

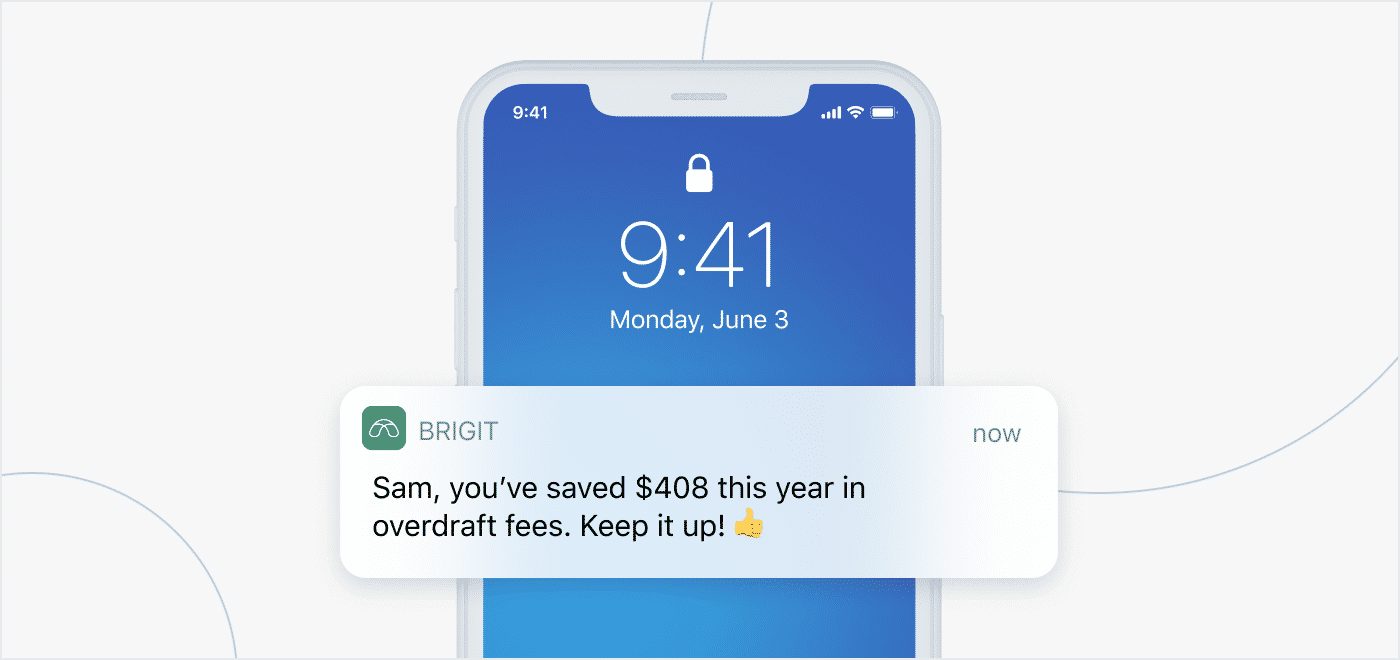

Our client Brigit delivers up to $250 of what you've already earned to your account within one minute, with no credit check needed. When your next paycheck arrives, Brigit automatically pulls the money out of your bank account.

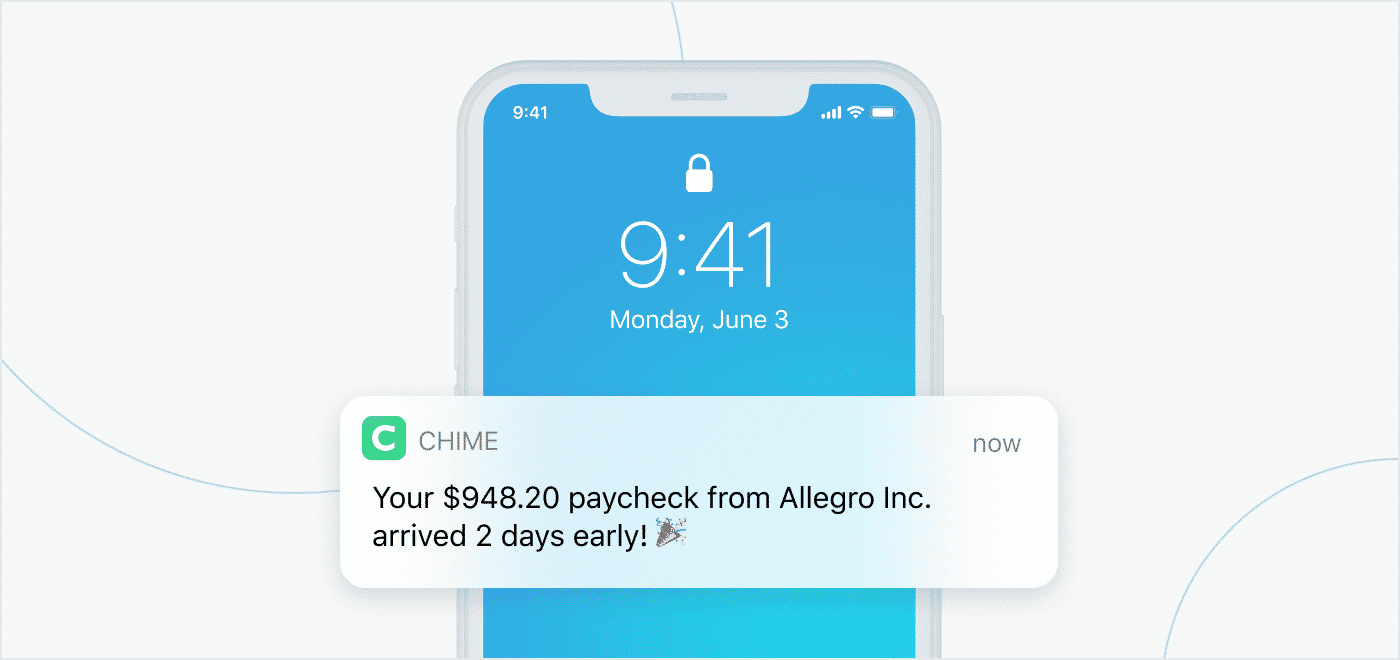

Fintech platforms are also exploring Early Direct Deposit, which lets account holders receive paychecks up to two days before payday.

One example is Chime ($1.5B of investment) — a fintech company that helps its members avoid bank fees. When you receive a direct deposit to Online Chime Spending Account, you can access funds up to two days in advance.

5. Collaborate!

As the banking industry changes rapidly, it becomes challenging for any institution to work on reform alone. By collaborating, banks can expand their platforms and products into new markets, integrate new features, and grow.

Open banking was introduced to bring more competition and innovation to the financial services industry. Using Open APIs enables third-party developers to build their services and applications around existing financial institution applications. As food for thought, the open banking market size is set to reach a cap of $43.15 billion by 2026.

Turn the insight into action

Based on customer experience and needs, go ahead, and prioritize bank capabilities from partners that can assist in six primary areas: payments, authorization, wealth management, lending, blockchain, and personal finance management.

Just a few examples

Open banking is driving the fintech market: without open banking, apps like Mint or Acorns couldn't function as they wouldn't sync automatically with a person's accounts.

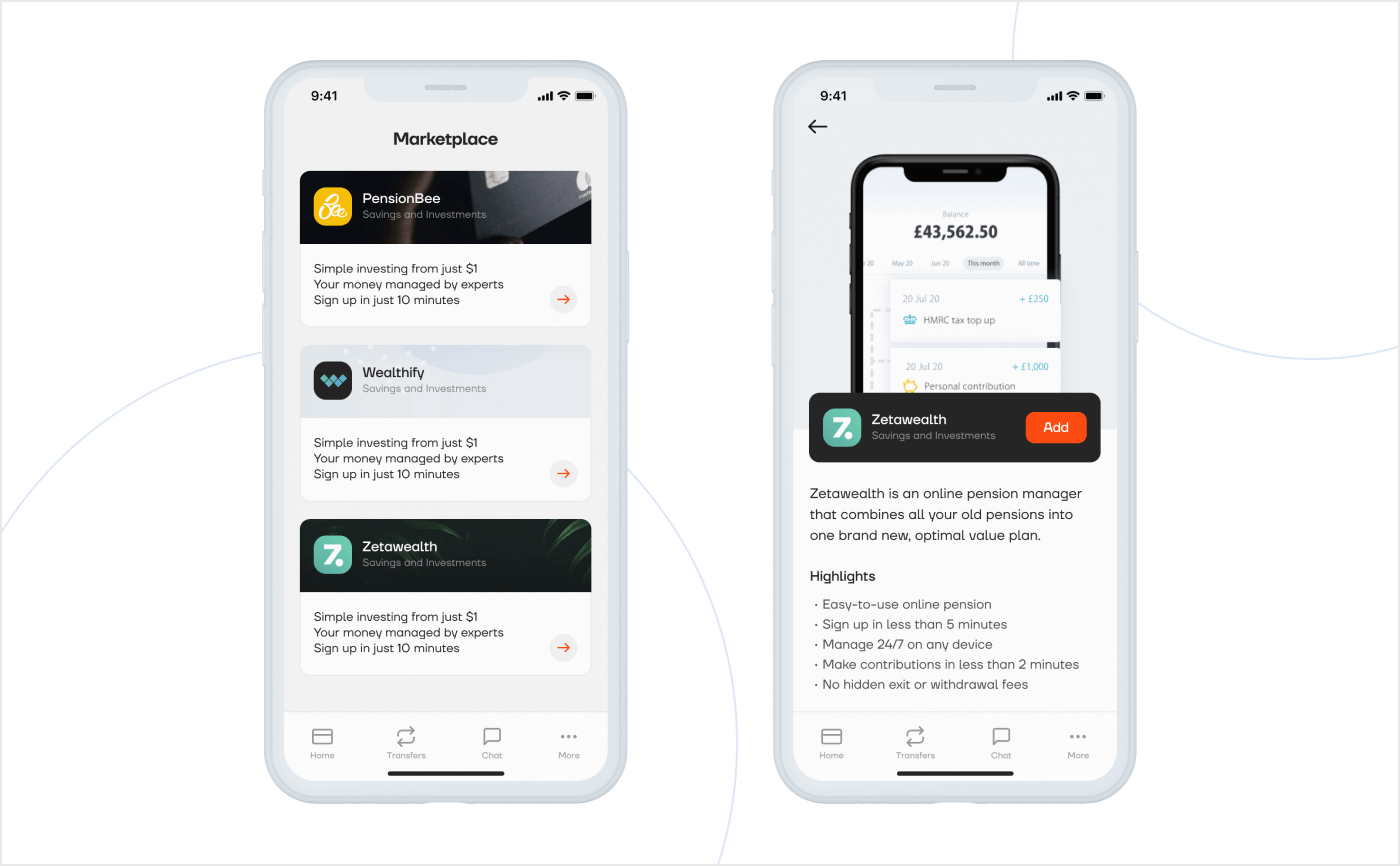

Starling Bank was designed with Open Banking in mind right from the outset. Its Marketplace – the space in the app where customers can browse and link third-party products and services to their bank account — is an example of going above and beyond regulatory requirements and really opening up banking for the better.

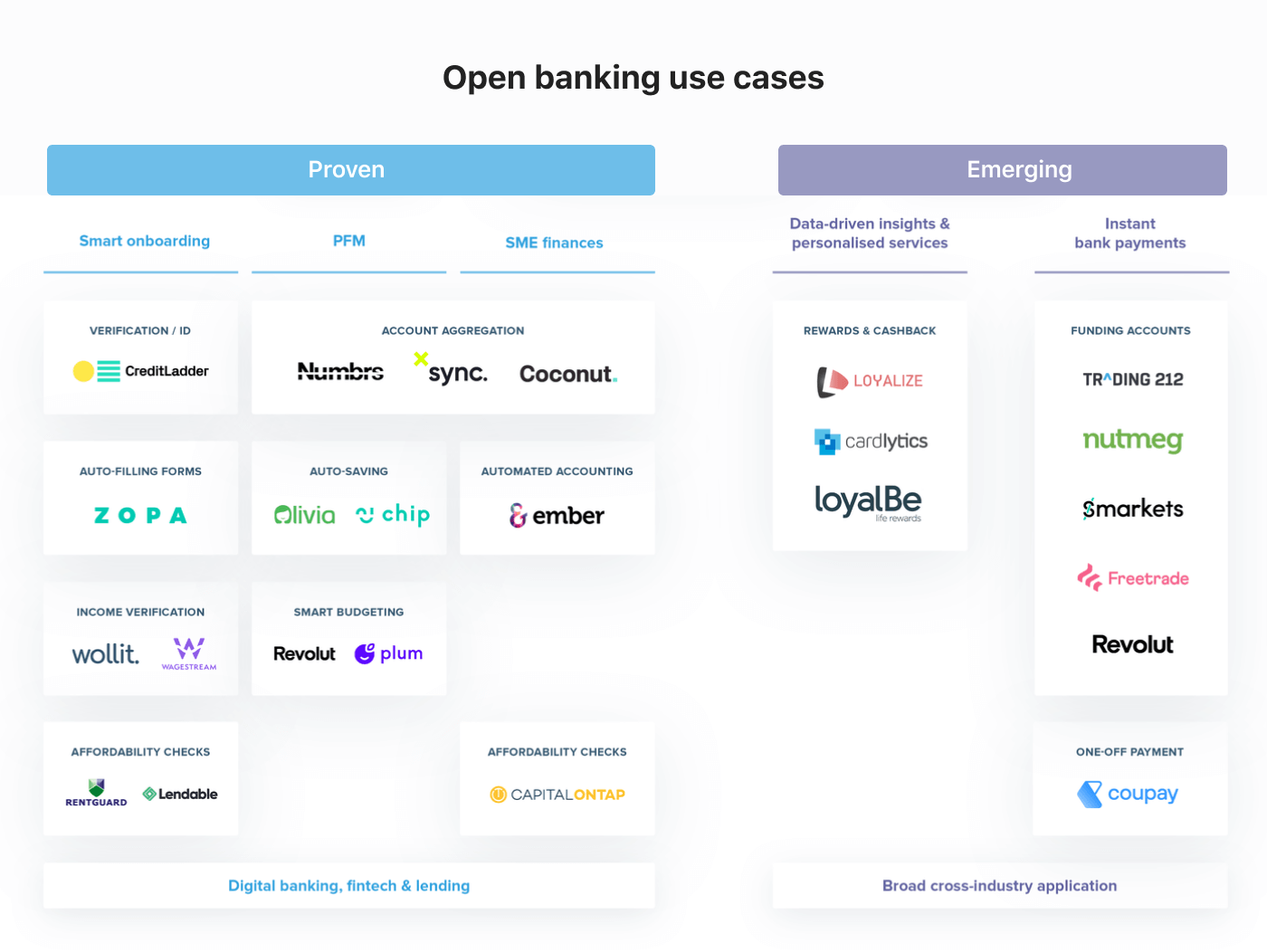

Globally there are 254 Open Banking companies; check out the open banking use cases provided by one of the industry leaders (TrueLayer):

In short, banks should only do well financially when their customers do well financially. So the big trends are the ones that are focused on the user's financial wellbeing.

Fintechs are flexible and adapt to future rules, while banks often rely on past success. The new age requires the ability to adapt quickly, and the Covid-19 crisis is a clear example.

We're all about sharing the good stuff, so if you enjoyed the article, why not tweet about it? And if you'd like to receive more case studies like this, subscribe to our newsletter. Also, subscribe to hear about legendary business pivots on our CTRL SHIFT podcast.