We know it's pretty challenging to quickly test product ideas as all methods like user interviews and customer journey maps are time-consuming (as hell). But we are about to show you a strategy to generate ideas faster, just in 5 easy steps.

Improved customer journey map — a shortcut

Let's use an example to illustrate this one. Google bank is a concept we created back in 2017. We posted it on Behance and other platforms, and here's a plot twist, it was released years later in the most recent Google Pay update in November 2020. What a coincidence :D

Our logic behind the Google Pay concept was derived from the idea generation tool we frequently use in the team. And as time has shown, it tends to provide reliable outcomes with real-world impact.

Our tip to idea generation is simple: don’t wait for customer suggestions. Create solutions inside the team.

To do this, identify the most time-(and effort) consuming aspect of your users' journey and offer a solution.

How?

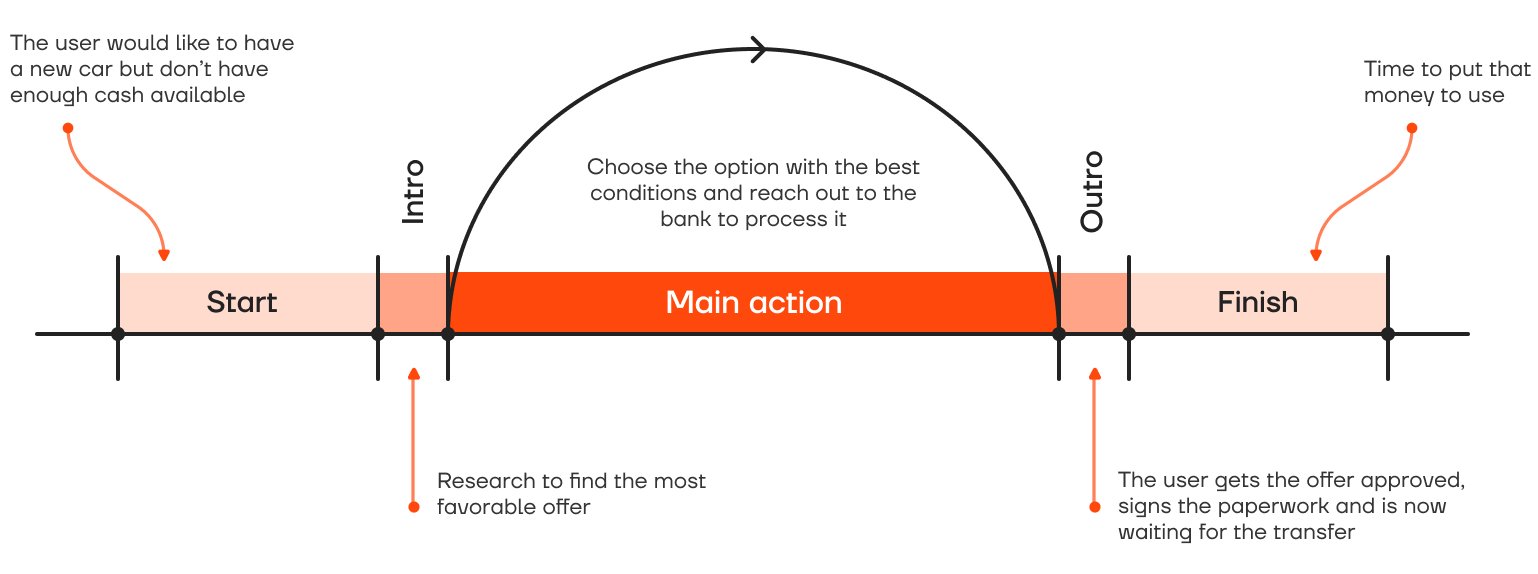

User journey can be described in five logical stages. The first thing on your to-do list should be identifying your users' key activities — which steps they take and in what sequence.

1. Start

The flow usually starts with an open need, for example, "I'd want to have a new car but don't have enough cash available."

2. Main action intro

Right before the key action (acquiring the money, in our case), it's logical to research the most favorable offer.

3. Main action

Let's imagine we're designing a fintech app. Consider users who are applying for a loan. The key action here is to acquire a loan from the bank on the most favorable terms. "Key" in this context is the action the entire flow is based upon. No money received — no reason to even get started.

4. Main action outro

The user gets the offer approved, signs the paperwork, and is now waiting for the transfer.

5. Last but not least: finish

Time to put that money to use.

As an example, a straightforward experience improvement would be to omit the actions preceding the main action. There wouldn't be a need to select the best loan offer if the only offer a user gets is the best one.

Another point — why take it all the way to the bank to file the paperwork (especially considering the pandemic outbreak) if the signature can be authorized from a mobile device.

With all of the above, the updated user flow of getting a loan looks as following:

- A burning desire to buy a new car.

- Getting access to a loan with the most suitable terms — interest rates and payback period.

- Receiving a money transfer.

Customer journey map vs. short customer journey map

We designed the updated version of the customer journey mapping aiming to eliminate all its shortcomings.

Comprehensive CJM is time-consuming.

If you look at any comprehensive guide to it (like this one), you'll immediately see it takes a minimum of a few days to create. On our side, it takes a maximum of 2 hours to complete the steps.

Experience has shown that when it comes to product development, speed outweighs the picture's scope most of the time. The updated version of the CJM is excellent for seeing the main opportunities for immediate improvements.

Full customer journey mapping can offer a very detailed outlook, but by the time you're done with the mapping, your fellow (and faster) team will have approved their prototypes for development.

critical web design mistakes to avoid

Summarized: how to create a realistic idea in a few hours 🏆

- Start with a key action of your customers.

- Ask the stakeholders what the surrounding process is, do the same thing with small customer groups.

- Map out the process in 5 fundamental steps.

- Identify what can be carried out by software instead of the users themselves.

- Design and release the solution. You win!

As you just saw, a short version of the customer journey mapping can be instrumental when you need an actionable idea in a limited time frame.

All you need is a profound knowledge of your customers. And who knows, maybe next time you'll foresee Google's big idea!

Subscribe to hear about legendary business pivots on our CTRL SHIFT podcast.